Over the earlier variety of years financiers haven’t had the power to buy semiconductor stocks rapidly ample. A big issue for this is because of the truth that modern chips known as graphics refining techniques (GPUs) are simply one of many core supply of energy of skilled system (AI) purposes akin to synthetic intelligence and in addition self-governing driving.

As the AI story stays to press the marketplaces better, chip provides will doubtless keep in excessive want. As it stands at the moment, Nvidia is usually thought of to be {the marketplace} chief amongst AI-powered chip enterprise. However, Nvidia merely knowledgeable financiers that the enterprise’s brand-new Blackwell series GPUs are going to be delayed due to a format defect.

While I’m no fan of schadenfreude, I see this bother at Nvidia as an distinctive minute for the enterprise’s most vital rival, Advanced Micro Devices ( NASDAQ: AMD) Let’s analyze the whole state of affairs helpful and analyze simply how AMD would possibly take advantage of Nvidia’s misstep.

A narrative of two chip enterprise

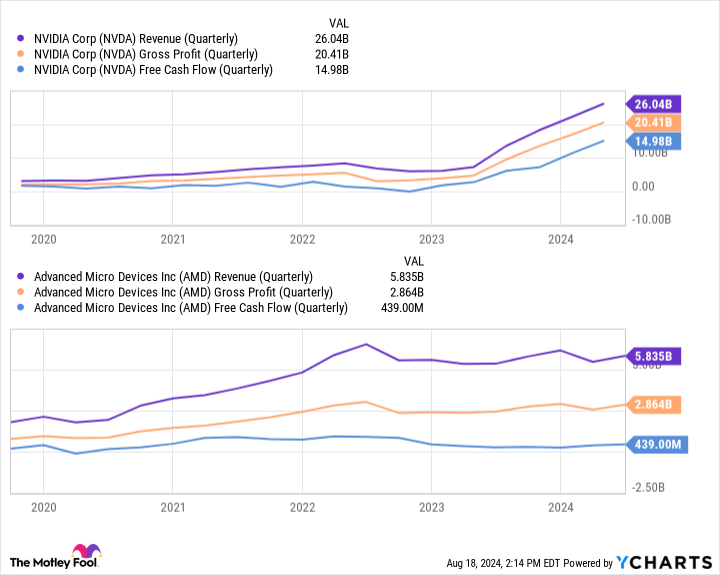

The graphes listed under present quite a lot of important financial metrics for Nvidia and AMD.

On one facet of the method, Nvidia’s gross sales and revenues are continually skyrocketing– inflicting a considerably steeper incline amongst the tinted strains portrayed listed under. Yet past, Nvidia’s major opponent is displaying seen variances in its process.

The traits confirmed over plainly recommend that chip purchasers not simply favor Nvidia, but are likewise able to pay main buck. Although Nvidia has truly stayed the superior semiconductor enterprise on condition that the creation of the AI change, AMD has an unbelievable likelihood to leapfrog Nvidia at the moment.

Why this can be AMD’s specifying minute

Wall Street specialists approximate that Nvidia has virtually 80% of the AI-powered chip market. While AMD has truly achieved what it may well to tackle Nvidia’s sensational pace of development, I assume the enterprise has truly principally tried to sidetrack financiers from Nvidia’s irritating lead by way of a group of suspicious purchases.

To me, AMD’s time is near going out and it cannot handle to depend on purchases as a useful resource of merchandise development and never pure improvement. One optimistic facet for AMD at the moment is that the enterprise’s MI300X accelerator GPU is the quickest merchandise to get to $1 billion in gross sales over the enterprise’s background.

Clearly, there may be an excessive amount of want for AMD’s GPUs, but it’s merely not additionally in the exact same breadth as Nvidia’s want. Now with Blackwell deliveries postponed until maybe sooner or later following 12 months, AMD has a possibility to confiscate the minute.

It’s important to stay primarily based

While the Blackwell hold-ups are by no means wonderful info, financiers require to be real under. I assume some enterprise will definitely select completely different treatments to Blackwell throughout, but I don’t assume Nvidia will definitely have a troublesome time providing these chips as soon as it finally fixings its type defect.

So though AMD more than likely isn’t mosting prone to unexpectedly document a irritating amount of market share and straight-out dethrone Nvidia, I assume the enterprise has a possibility to spice up its account by interfering with Nvidia’s power.

For at present, it’ll be virtually troublesome for financiers to know if AMD is passing by {the marketplace} whereas Nvidia concentrates on righting the Blackwell ship. I assume some smart actions may be to maintain monitor of reports launch amongst vital AI programmers akin to Microsoft, Amazon, Alphabet, or Oracle and see if any one in every of them stand out brand-new collaborations with AMD or buying much more MI300X chips.

Although I don’t very personal AMD provide at present, I’m inquisitive about the current traits of the chip market and see the enterprise as each a bush to Nvidia and corresponding to a long-lasting telephone name different on the AI market further extensively.

Investors with a better resistance for risk, nonetheless, would possibly take into consideration buying AMD at present. Given the enterprise is taking part in 2nd fiddle to Nvidia, it’s powerful to examine a circumstance the place AMD falls again in the course of this Blackwell state of affairs.

Another technique may be to attend a lot of months until AMD releases its following revenues document and see if the enterprise produced unusual improvement contrasted to earlier durations. Investors should likewise take note of administration’s discourse pertaining to the useful resource of brand-new firm.

In both state of affairs, I’m favorable that AMD will definitely take advantage of Nvidia’s stumble and presumably spark the stimulant required for longer-term continuous improvement as each enterprise proceed going face to face within the chip world.

Should you spend $1,000 in Advanced Micro Devices at the moment?

Before you buy provide in Advanced Micro Devices, take into account this:

The Motley Fool Stock Advisor skilled group merely decided what they assume are the 10 best stocks for financiers to buy at present … and Advanced Micro Devices had not been amongst them. The 10 provides that made it’d create beast returns within the coming years.

Consider when Nvidia made this itemizing on April 15, 2005 … should you spent $1,000 on the time of our suggestion, you will surely have $758,227! *

Stock Advisor provides financiers with an easy-to-follow plan for achievement, consisting of assist on creating a profile, regular updates from specialists, and a couple of brand-new provide selections month-to-month. The Stock Advisor answer has better than quadrupled the return of S&P 500 on condition that 2002 *.

*Stock Advisor returns since August 22, 2024

Suzanne Frey, an exec at Alphabet, belongs to The Motley Fool’s board of supervisors. John Mackey, earlier chief government officer of Whole Foods Market, an Amazon subsidiary, belongs to The Motley Fool’s board of supervisors. Adam Spatacco has settings in Alphabet, Amazon, Microsoft, andNvidia The Motley Fool has settings in and advises Advanced Micro Devices, Alphabet, Amazon, Microsoft, Nvidia, andOracle The Motley Fool advises the complying with selections: prolonged January 2026 $395 get in contact with Microsoft and transient January 2026 $405 get in contact withMicrosoft The Motley Fool has a disclosure policy.

AMD’s Leapfrog Moment Has Arrived. Here’s Why Now May Be a Once-in-a-Lifetime Opportunity to Buy the Stock. was initially launched by The Motley Fool